Colin Nabity, CEO of Breeze, answered MUG.NEWS questions about insurtech, financing and the problems his company is solving within the field of disability insurance. Grab your mug of coffee or tea and read on for his expert commentary.

MUG.NEWS: Please define the term Insurtech for readers.

Insurtech is short for “insurance technology,” and it’s all about leveraging technology to enhance and streamline insurance operations, including the application process. Insurance companies, especially younger startups, are using big data to transform an antiquated industry.

Breeze is an insurtech company as we have built technology and an on-line platform to simplify the process for buying income protection products like disability and critical illness insurance.

MUG.NEWS: Are we in an unusual funding cycle for Insurtech companies?

When it comes to insurtech funding, it’s been a record-setting year. According to Willis Towers Watson (a British multinational, risk management, insurance brokerage and advisory company), global insurtech funding had already hit $7.4 billion in just the first half of 2021. This partial number surpassed total annual insurtech funding from any previous year. In Q2 2021 alone, there were 162 insurtech funding deals, including Breeze’s Series A round.

MUG.NEWS: Describe the funding that Breeze received this year.

Breeze raised $10 million in Series A funding in early August 2021. The round was led by Link Ventures and received participation from Northwestern Mutual Future Ventures, Silicon Valley Bank, M25, Fiat Ventures and Invest Nebraska.

This amount was the largest first round of institutional capital ever invested in a Nebraska-based software startup. The funding will be used to build out our internal teams and enhance product offerings.

MUG.NEWS: Tell our readers about your technology in simple terms.

Our technology considers a variety of personal factors, including age, occupation, and health history and then combines these factors with more far-reaching data analytics in order to provide someone with a quote for disability or critical illness insurance in a short amount of time.

We’ve basically automated and expedidited the underwriting process that has forever been completed manually by a human underwriter.

MUG.NEWS: How has your technology made the funding possible? What about the human factor that your company is influencing through changing your industry?

Our tech has made the funding possible because it has created a long overdue direct-to-consumer marketplace for disability insurance and critical illness insurance.

We leveraged big data and tech to simplify, speed up, and digitize the application process for these products and that has led to the Series A round. The income protection space was in need of innovation and that’s what Breeze is bringing.

MUG.NEWS: Was there a defining moment(s) or idea that led to your creation of Breeze?

We’ve been in this space for almost 10 years and have seen first-hand the challenge of underwriting and selling these products digitally. Income protection is easily one of the most important types of insurance that working Americans should have, but it’s been one of the most difficult for people to obtain due to a complicated application process.

MUG.NEWS: As a follow-up, what is the story behind the naming of your company?

Insurance is known for being stagnant, boring, and unnecessarily difficult. We wanted our brand and our name to reflect simplicity, speed, and trust while giving us flexibility to be creative in our marketing approach.

We are making buying disability insurance and critical illness insurance a Breeze.

MUG.NEWS: To continue your thought, how is Breeze changing the field of disability insurance?

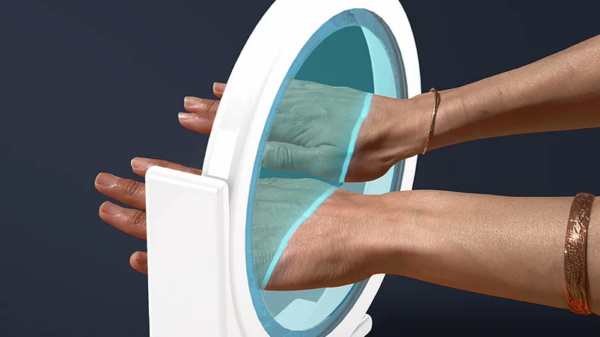

We are simply making it an easier product to buy. Using Breeze, you can get a quote for disability insurance in just minutes. You could be approved in no time at all and possibly without a medical exam.

Before Breeze, consumers struggled to find and buy disability insurance. There was no simple, online marketplace to apply for this product. With Breeze, it’s never been easier for consumers to look into disability insurance in an online environment.

We’re mission-driven. Specifically, we want to close the income protection gap. This refers to the relatively small disability insurance market when compared to life insurance, although stats suggest disability insurance could be far more useful than life insurance for the average consumer.

MUG.NEWS: In sum, Breeze is a clever Omaha, Nebraska based company, using technology and $10 million in 2021 funding to simplify the purchase of disability and critical illness insurance.

MUG.NEWS appreciates Colin Nabity, CEO and Michael Brown, Breeze’s Director of Communications, for sharing their story of the idea, funding and technology behind Breeze.