The Omaha based disability insurance company Breeze just made history by securing $10 million in Series A funding. The round’s lead investor is Link Ventures, with contributions from Invest Nebraska, Northwestern Mutual Future Ventures, Silicon Valley Bank, and Fiat Ventures. The $10 million investment is the largest amount raised by any software-based Nebraska company.

Breeze was started by entrepreneur Collin Nabity, who had worked in the field of disability insurance for ten years, but felt that not everyone had access to the product that he was selling. Nabity’s solution to this problem was to start his own disability insurance company with partner Cody Linch. Together, the team at Breeze have been making disability insurance more accessible since 2019. The company may be young, but that has not stopped it from being recognized as one of the best disability insurance options available. Good Financial Cents named Breeze the best disability insurance company of 2021 and Investopedia crowned the company the “Best Long-Term Disability Insurance Provider.”

Why Disability Insurance Matters

Most have seen the Aflac commercials in which the company promises to give its injured customers money when they’re hurt and can’t work due to injuries. The duck, in these commercials, gives the money to a person who is shown wearing a neck brace or confined to a wheelchair, demonstrating that the injured person’s injuries are keeping them from working; in reality, disability insurance is so much more than that.

The Council for Disability Awareness reports that more than 90% of the filings for long-term disability benefits are caused by medical illness—not physical injury. Examples of illness covered by disability insurance can include, but are not limited to: arthritis, back pain, cancer, depression, diabetes, heart disease, and stroke.

Disability insurance can also be the difference between bankruptcy and making it through the most trying time a family or individual can experience. If there is no income due to disability, then individuals and families can apply for Social Security Disability Insurance (“SSDI”). However, from 2006 to 2015 only 34 percent of SSDI applications were approved. Not to mention that the average processing time was more than 18 months—far too long for most people to wait on receipt of their next paycheck. Lastly, SSDI is unlikely to provide enough benefits to support average living standards pre-disability. In 2018 the average benefit of SSDI was $1,197 a month. Over the course of a year this comes out to just $14,364—just barely above the poverty line (Council for Disability Awareness).

Breeze is Making Waves

Like many industries, disability insurance providers had a “if it ain’t broke don’t fix it” approach to the way that they sold insurance. Nabity recognized that the disability insurance industry’s processes are outdated and could be improved with modern technology, giving consumers an easier, more affordable experience.

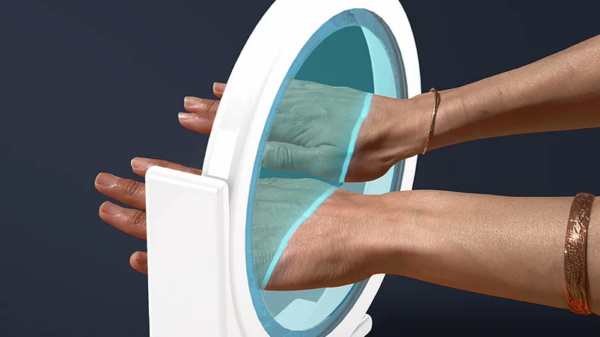

Breeze advertises a 10 minute application that uses big data to allow customers to buy their policies completely online and avoid visits to the doctor as much as possible. This creates lots of savings for Breeze, which it is then able to pass down to the customer. This means that a policy worth thousands of dollars a month, if the policy holder becomes disabled, has only a $20 premium, on average.

Nabity told Silicon Prairie News recently, “Our streamlined online experience provides consumers a quick, convenient way to find coverage without enduring high-pressure sales tactics or archaic processes that have plagued the insurance industry in the past.”

With this Series A funding, the company is looking to add new products, carriers, and agents to its platform. Breeze will also be adding the marketing, software development, distribution, and customer service as the company expands.

Other major players in the disability insurance field notwithstanding, including Aflac, Assurity, Ameritas, Northwestern Mutual, to name a few—Nabity feels confident that Breeze has cracked the code to providing a superior product to a market that was underserved for so long due to high prices and red tape.

“We founded Breeze to close a glaring coverage gap—specifically, the 51 million working Americans without adequate income protection,” Nabity said. “Historically, products like disability income insurance and critical illness insurance have been overpriced and too difficult to obtain. We’re changing that (SPN).”

The Future is bright for Breeze; the company is proving that insurance-based start ups can thrive in Nebraska. With this new funding the company is looking to become an insurance power in the near future.